SEC Crackdown On Crypto?

Everything You Have To Know

Mr. Longtail’s Diary

Dear Readers,

Yes, it’s this time of the year – the controversial yet celebrated Valentine’s Day is almost here! 💘 I am wondering if we can count on some love from the crypto market or rather a cold treatment.

What do you think?

Sending you lots of love! ❤️❤️❤️

Mr. Longtail 🐭

This week’s tasty snacks:

💝 - Market outlook: UP or Down? Both cases for $BTC

💝- Hot News: SEC Crackdown On Crypto

💝 - Project Review: Vovo Finance

💝 - Those sweet, sweet memes!

💝 - Your favourite motivation corner!

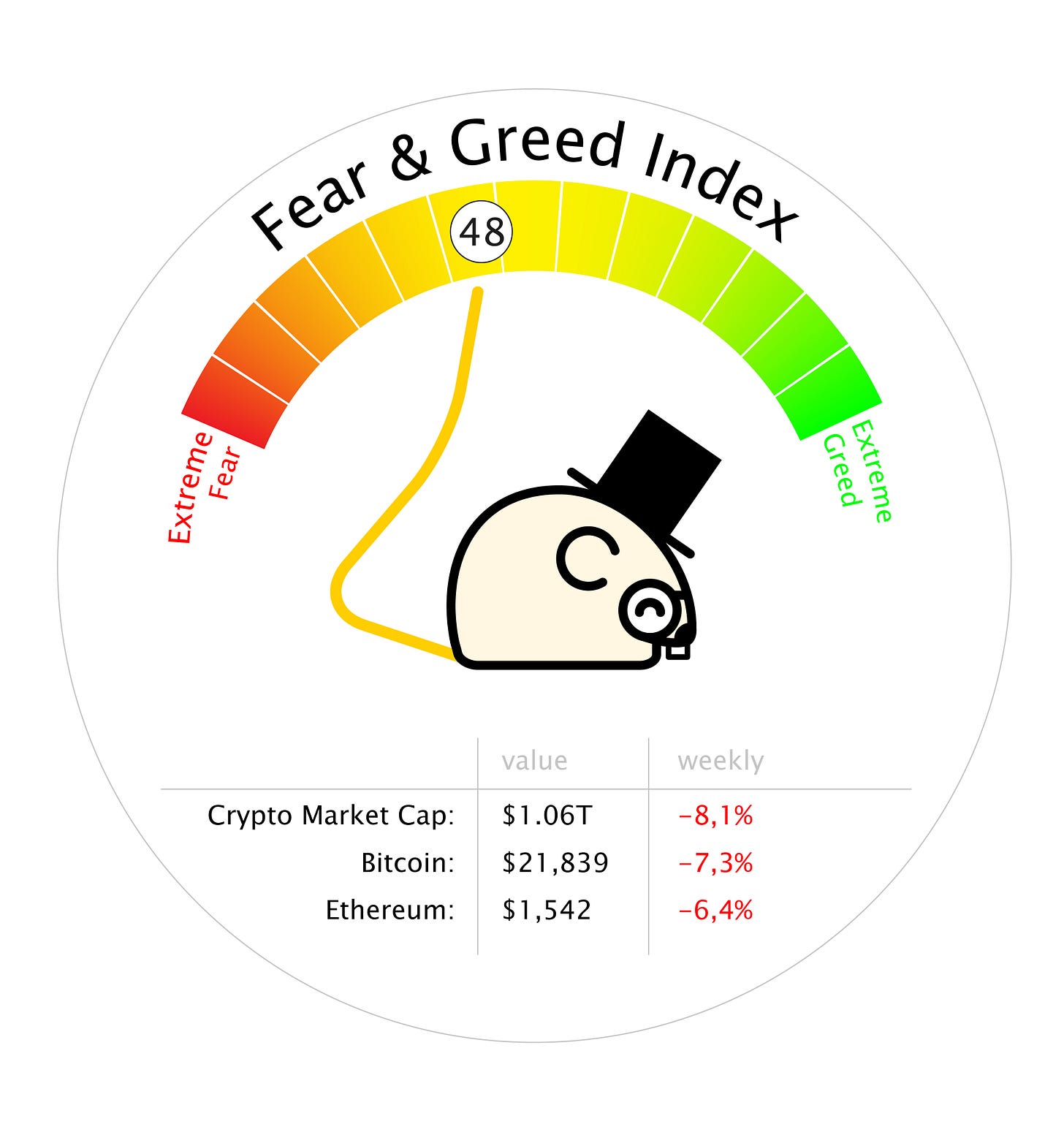

Market Outlook

As they often say: “Stairs up, elevator down…”

UP or DOWN? ☝️👇

The year 2022 has been a challenging one for the cryptocurrency market, including Bitcoin, which has lost approximately 65% of its market value. This was due to several unfortunate events such as the Terra Luna crash, the fall of the largest crypto exchange FTX, and the uncertain macroeconomic conditions. As we move into 2023, the question on everyone's mind is what will happen next to the largest cryptocurrency in the world? Will it recover or will it continue to crash like in 2022?

In this text, we will explore both the bullish and bearish views on Bitcoin's future in 2023.

Bullish View 🐂

Bitcoin is currently trading at around $23,000, which it first crossed on January 21, 2023 after six months of stability. At the time of writing, the daily trading volume of Bitcoin is around $21.8 billion. Despite its reaction to every move of the Fed meeting, pro-investors are optimistic about Bitcoin's future and are looking for it to stabilize beyond the $23,000 level.

Positive signals were observed when Bitcoin crossed the crucial level of $16,800 and showed a bullish trend. Currently, the technical indicators are as follows:

Hourly Moving Average Convergence/Divergence (MACD) is gaining pace in the bullish zone

Hourly Relative Strength Index (RSI) for BTC/USD is above 85

Support levels: $22,700

Resistance levels: $22,900

Experts are bullish on Bitcoin as the year 2024 marks the next Bitcoin halving event. The halving happens every four years, where the rewards to miners are cut in half, reducing the miner's payout to 3.125 BTC. Historically, halving has been seen as a positive sign for Bitcoin's price as it helps to contract supply. The limited supply of Bitcoin, being a decentralized cryptocurrency, cannot be printed by governments or central banks, making it a deflationary asset.

Another reason for the bullish view is the recent less aggressive rate hike of just 25 basis points by the US Fed, which has helped Bitcoin maintain its rising trajectory and outperform other asset classes. Additionally, large investors, known as "Bitcoin Whales," have started accumulating BTC once again. According to Santiment, the Bitcoin whales are holding between 1,000-10,000 BTC in their wallets, which could indicate a recovery in Bitcoin's price.

Bearish View 🐻

On the other hand, some investors, corporates, and large institutions hold a bearish view on Bitcoin and believe that it might fall in the near future. They see this rally as a major "bull trap" rather than a "bull run." For example, billionaire investor Mark Mobius predicted a huge fall in 2022 and believes that Bitcoin could even fall to the $10,000 range.

Similarly, Matthew Sigel, head of digital assets research at VanEck, a global investment manager, predicts that Bitcoin will drop to $12,000 levels due to higher energy prices. Global bank Standard Chartered also surprised the market with their prediction that Bitcoin could fall to $5,000 levels in 2023.

Experts believe that the rising interest rates and tighter monetary policy will not allow Bitcoin to rebound sharply in the near future. In uncertain markets, investors tend to shy away from risky assets like Bitcoin, and those who have been holding it may sell their positions, causing undue pressure on the market.

Conclusions

In conclusion, there are various views and predictions on Bitcoin's future, but only time will tell where it will head. Despite its ups and downs, Bitcoin has shown its resilience over the past decade and has helped investors make substantial fortunes. We are long!

Disclaimer: The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. The content of this newsletter is solely the opinions of the writers who are not a licensed financial advisors or registered investment advisors. Trading cryptocurrencies poses considerable risk of loss. Authors of this newsletter do not guarantee any particular outcome.

Latest News

SEO Crackdown on Crypto?

‘The Securities and Exchange Commission’s charges and subsequent settlement with exchange Kraken over its staking service on Thursday signal a new step for the regulatory agency’s crypto crackdown.

Some called it a step in protecting investors, while others said it would move business offshore.’

Find out more at theblock.co

Paris Hilton and Her Metaverse Dating Project

‘Beginning February 13, players entering Parisland will be able to virtually meet five other players, complete quests, and ultimately choose a partner.

According to a statement, the gamified experience is being billed as an “imaginary reality show” in the metaverse. Besides hitting on random strangers online, activities in Parisland include shopping for outfits, selecting wedding rings, investigating a secret inside a burger (yes, really), and “rescuing a castaway.”’

Find out more at decrypt.co

Mississippi Senate Protects Crypto Miners

‘The American state of Mississippi is one step closer to protecting the rights of cryptocurrency miners after the state Senate passed the Mississippi Digital Asset Mining Act on Feb. 8. There is a companion bill under consideration in the state House of Representatives.

The Senate bill, authored by state Sen. Josh Harkins, legalizes home digital asset mining and the operation of mining businesses in areas zoned for industrial use. There are already crypto miners operating in Mississippi, which has some of the lowest electricity rates in the country.’

Find out more at cointelegraph.com

Financial Institutions Betting on Crypto in 2023

‘As Bitcoin hovered around $38,000 last April—down 45% from its peak—Fidelity Investments announced its customers could soon add the digital asset to their retirement accounts through a first-of-its-kind offering.

By the time the firm’s 401(k) product launched the following fall, the value of Bitcoin had sunk even more, hammered throughout the summer by a tightening economy and fallout from the $60 billion implosion of cryptocurrencies Luna and TerraUSD. Bitcoin was changing hands at $20,000 by early November.’

Find our more at decrypt.co

Project Review

Vovo - On-chain Structured Products

What is Vovo?

Vovo Finance is a protocol that offers a range of structured products to cater to users with different risk appetites. Its products include Principal Protected Products, which offer the opportunity to earn large profits without the risk of losing any assets, and Yield Enhancement Products, which allow users to earn high returns by taking on the risk of their choice.

One of the key advantages of Vovo Finance is its fully automated, on-chain operation. Unlike many other structured products projects that rely on off-chain market makers and face the risk of centralization and liquidity shortages, Vovo sources its liquidity from other on-chain DeFi pools, eliminating the need for trust in third parties.

Use cases

Designed for both risk-averse and adventurous users, Vovo Finance offers an organic yield from derivatives, regardless of market conditions. It also provides easy access to on-chain financial instruments, democratizing derivatives and interest rate products for those without deep financial knowledge.

Vovo's keeper handles the rebalancing activities for all users through an aggregated pool, reducing operational and gas costs and making passive investing more accessible and cost-effective. In the long run, Vovo aims to become an ecosystem that enables unlimited offerings of passive investment products with customized payoffs.

Find out more and test the dapp at vovo.finance! I think that your future self might be thankful if you do! 🪂🎁

Disclaimer: The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. The content of this newsletter is solely the opinions of the writers who are not a licensed financial advisors or registered investment advisors. Trading cryptocurrencies poses considerable risk of loss. Authors of this newsletter do not guarantee any particular outcome.

Memes of the Week

At Least There Are No Calories in Metaverse…

Happy Valentine’s Day!

You Have to Stay Positive…

Mr Longtail’s Motivation Corner

Quote and Book of the Week

‘Talk to yourself like someone you love.’

Brené Brown, Daring Greatly

5 Tips to Self-Love ❤️

As the Valentine’s Day is coming, we prepared for you five tips to self-love, because the most important relationship we have is the one with ourselves. May sound cliché but it is nevertheless true.

❣️Be happy with yourself first and then make other people happy. Prioritising the needs of other people all the time, even the loved ones, means that we consider our talents, dreams not valuable enough to focus on.

❣️Take time to reflect and to ground yourself. This way you will know yourself better and thus, you will make better decisions for yourself, and not for others.

❣️Communicate your needs and feelings to yourself and then to your loved ones. We often hide our true self because well, life happens. However, life is short and fragile so we might as well think what we really want in life. Communication is key – remember that our loved ones may have no idea what would make us happy until we will let them know.

❣️Take care of your body. Body and mind are interconnected, and research shows that we literally are what we eat (well, then I apparently am a Pinterest cheese board since I am a mouse). But jokes aside, when you eat at least 80% healthy and move, you show respect and love to your body.

❣️Finally, rest well when you need it. Dedicate the time in your day when you can disconnect and just be. Relax, recharge, take a nap if you need it. Commit to taking your rest seriously.

Disclaimer: The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. The content of this newsletter is solely the opinions of the writers who are not a licensed financial advisors or registered investment advisors. Trading cryptocurrencies poses considerable risk of loss. Authors of this newsletter do not guarantee any particular outcome.

Interested in advertising on the Longtail Report?

Contact us at: longtail.report@protonmail.com

We’ll get back to you asap!