January was green, but what's coming in February?

Market Outlook for the month!

Mr. Longtail’s Diary

Dear Readers,

Today’s message will be all about the famous self-care.

I have realised that since the past couple of months I have been neglecting myself, while working super hard. Yes, your fav mouse is a hustler. But also, it is a living creature. And as all living creatures it needs sun, fresh air, movement and nutrients.

Upon some reflection, I concluded that artificial light of my computer screen can’t give me the free antidepressant that is Vitamin D.

That’s why I decided to take some days off and go to the spa. I will be chilling, try to do nothing, swimming and have some good time. I realized I need to recharge my batteries in order to purse my ambitious goals.

Meanwhile, enjoy the newest Longtail Report! Happy Friday y’all!

Stay strong!

Mr. Longtail 🐭

This week’s tasty snacks:

🥬 - Market outlook: Green January, What’s coming in February?

🧀 - Hot News: SBF Bail Drama; Silvergate Stock

🧀 - Project Review: Gumball.fi - When NFTs meet Defi! 🟣

🍰 - Those sweet, sweet memes!

🍓 - Your favourite motivation corner!

Market Outlook

Green January 🥬🥑🥒🥦

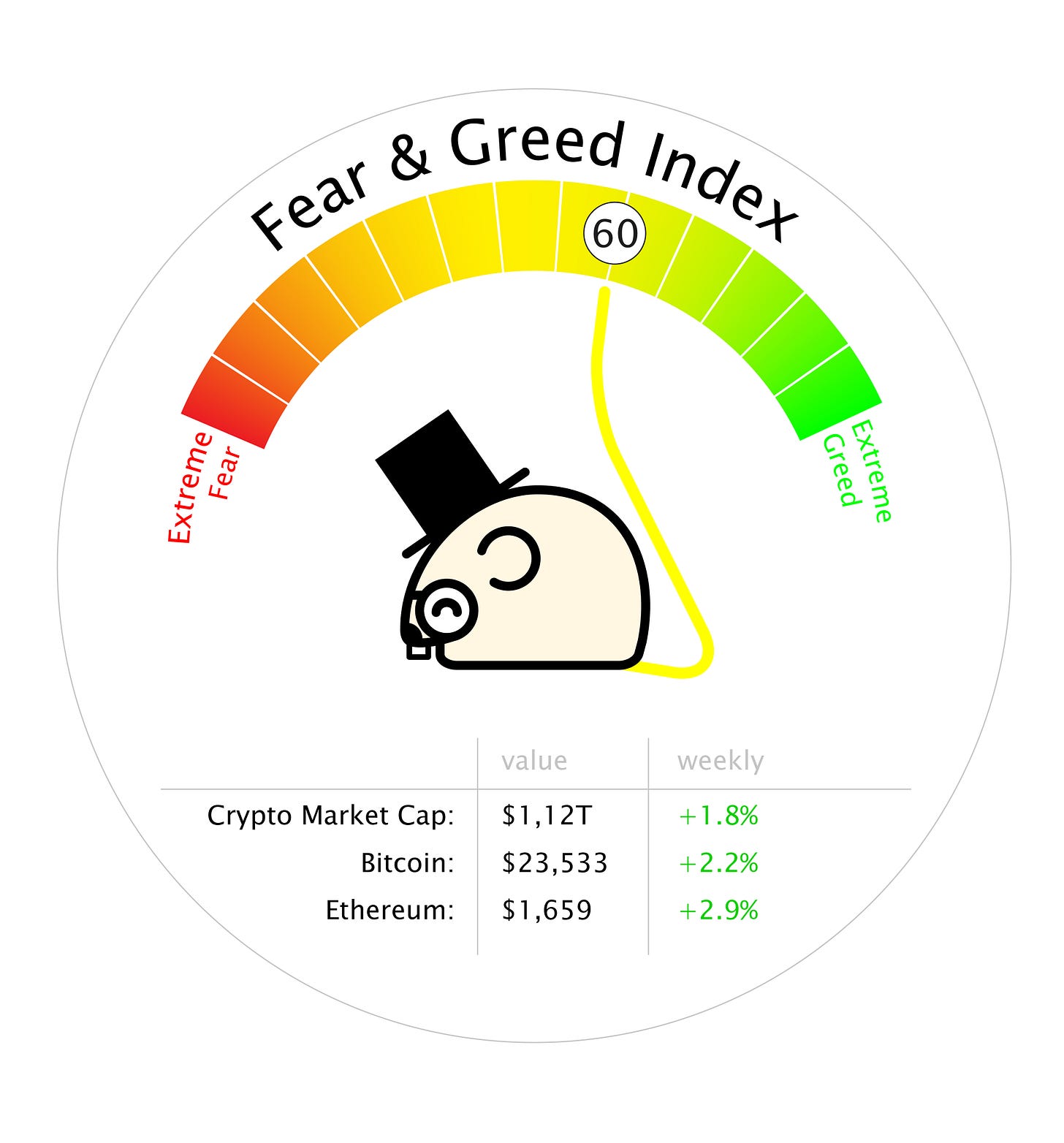

In November 2022, the price of Bitcoin (BTC) briefly fell to a two-year low below $15,600 due to the FTX bankruptcy filing. However, the cryptocurrency market regained its strength in early 2023 with a 37% increase in BTC prices to end the month of January at over $22,900. Ethereum (ETH) also saw a 30% rise in January, ending the month at $1,577.

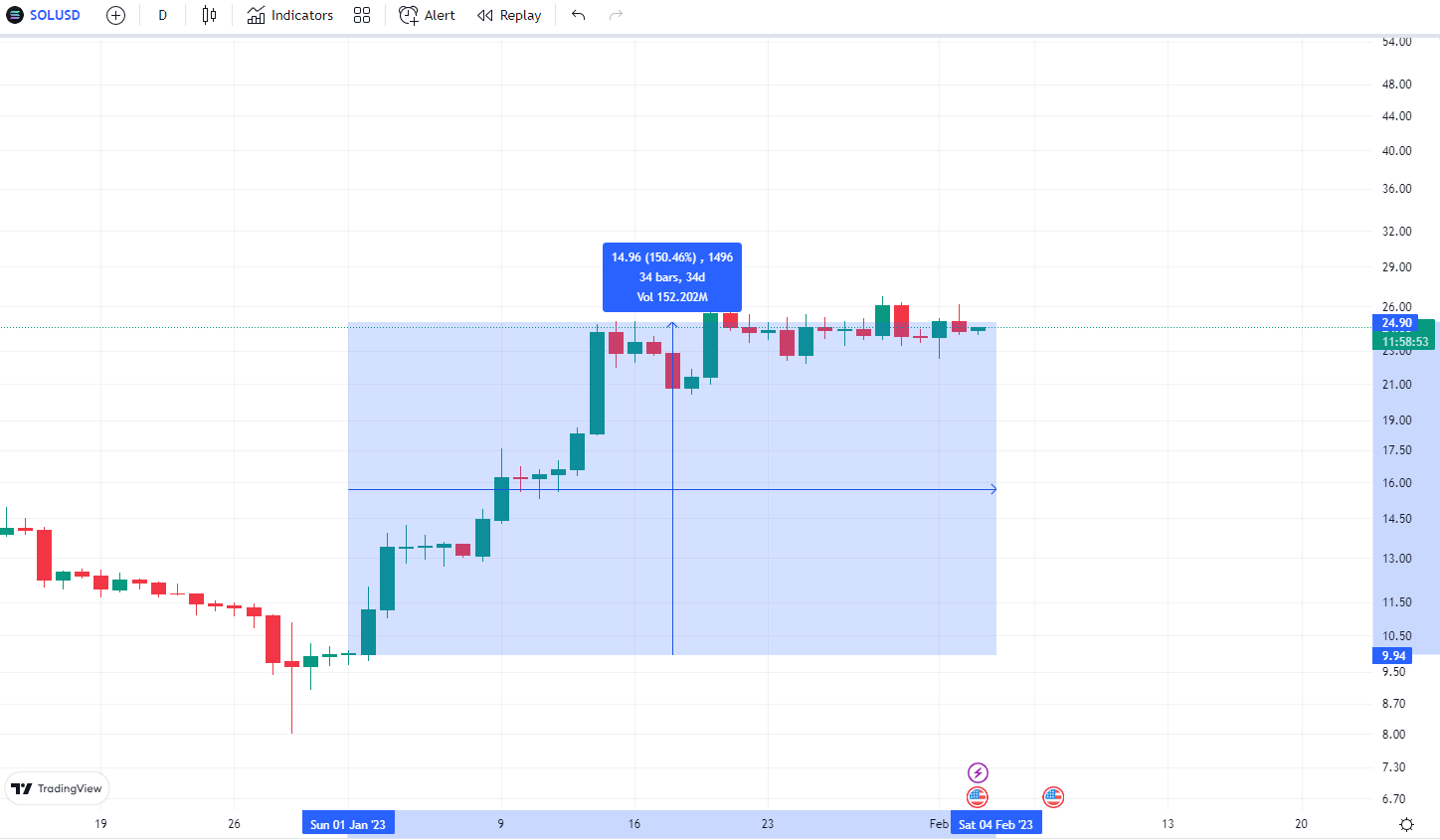

Out of the top 10 cryptocurrencies by market capitalization, Solana (SOL) had the highest growth in January with a remarkable 150% increase, while XRP (XRP) had the lowest increase at 15%.

The positive January performance has brought hope to crypto investors after a disappointing year in 2022, with Bitcoin and Ethereum having their worst annual results since 2018.

What’s Coming in February?

Crypto markets have been impacted by macroeconomic data and monetary policy decisions, and February holds several important events that could impact market trends. The Federal Open Market Committee (FOMC) recently raised interest rates by 25 basis points at the conclusion of its meeting on February 1. Ryan Dunn, a certified financial planner and wealth manager at Novi Wealth, suggests that crypto investors keep a close eye on the Fed, as their decisions are likely to drive crypto prices. If the Fed raises rates higher or for a longer period than expected, it could result in a decline in crypto prices.

Two important events for the crypto market are also taking place in February, the European Blockchain Convention and the tenth annual Blockchain Life forum. The European Blockchain Convention is set to take place on February 15-17 in Barcelona, and it will feature over 200 speakers discussing the future of blockchain, NFTs, decentralized finance, and Web 3. The Blockchain Life forum will be held on February 27-28 in Dubai. These events will provide insight into the future of the crypto market and could have a significant impact on market trends.\

Disclaimer: The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. The content of this newsletter is solely the opinions of the writers who are not a licensed financial advisors or registered investment advisors. Trading cryptocurrencies poses considerable risk of loss. Authors of this newsletter do not guarantee any particular outcome.

Latest News

Keeping up with The Bankmans Season 2 Episode 1 ‘Who Paid the Bail?’

Former FTX CEO Sam Bankman-Fried has been ordered by Judge Lewis Kaplan of the Southern District of New York not to contact current or former employees of FTX. This is one of the bail conditions. In earlier filings, prosecutors stated that in SBF contacted FTX US general counsel Ryne Miller via the encrypted messaging app Signal.

As for the bail itself, it is already known that SBF’s parents co-signed his $250 million bail. However, there were also two other people involved in the bail procedure and now, according to the judge’s recent ruling, the identity of them can be made public.

Curious to find out who helped SBF?

Find out more at Cointelegraph

Crypto Trading and Lending Regulated Soon in the UK

The UK government intends to introduce ‘clear, effective, timely regulation and proactive engagement with industry’. Hence, the plan is to cover crypto service providers, lending platforms, prudential requirements, consumer protection, crypto issuances and disclosures. The aim is to prevent market abuse. Until the end of April the crypto industry will be submitting responses.

Find out more at Theblock

Bitcoin and Ether Adresses Connected to Russia Blacklisted

A Bitcoin and Ether addresses linked to sanctions evasion has been blacklisted by The U.S. Treasury Department's Office of Foreign Assets Control (OFAC).

Russian nationals related to the addresses, Igor Zimenkov and his son Jonatan are allegedly part of ‘a broad network of individuals and entities’, trying to sell defense equipment to ‘third-country governments’.

Find out more at Coindesk

LBRY vs. SEC: ‘Secondary Sales Aren’t Securities’ - Good News for Ripple?

‘A judge clarified that LBRY Credit Tokens, known as LBC, are only considered securities at the time of direct sale, a ruling that could potentially bode well for Ripple.

During an appeal hearing in New Hampshire Monday, the judge said the summary judgment handed down in November, which sided with the Securities and Exchange Commission (SEC), does not apply to secondary sales of LBC.

In the summary judgment, the judge argued that the tokens incentivized the team to build the network, suggesting to investors that LBC would be a profitable investment on the secondary market.’

Find out more at Blockworks

Record Set by Crypto Hackers: US$3.8 bln in 2022 stolen

‘Decentralized finance (DeFi) platforms were cybercriminals’ favorite target, accounting for more than 82% of the cryptocurrencies stolen in 2022, according to the report.

DeFi offers access to financial instruments directly through the blockchain and smart contracts rather than through intermediaries such as brokerages, exchanges, or banks.

Of the funds stolen from DeFi protocols last year, 64% came from cross-chain bridges, which are blockchain infrastructures that allow investors to use crypto assets from one blockchain on a different blockchain.’

Find out more at Finance Yahoo

World’s Largest Asset Manager BlackRock Bought Silvergate Stock

‘The world’s largest asset manager, BlackRock BLK +1.06% , disclosed a significant position in Silvergate Capital SI +29.13% , the beaten-down banker to the cryptocurrency industry whose share price has been a high-profile casualty of the crypto meltdown. BlackRock isn’t the only bullish one.

In a filing Tuesday with the Securities and Exchange Commission, BlackRock (ticker: BLK) disclosed a 7.2% stake in Silvergate (SI), representing 2,285 shares purchased on Dec. 31. It makes BlackRock one of the bank’s largest shareholders, with its BlackRock Fund Advisors arm owning an existing 5.6% stake.’

Find out more at: Finance Yahoo

Project Review

Gumball.fi - When NFTs meet Defi! 🟣

Non-fungible or fungible?

GumBall Protocol is a platform that combines NFT creation and trading. When a new NFT collection is launched on the platform, an equivalent amount of ERC20 tokens, called GumBall Tokens (GBTs), are created for that collection. These tokens are unique to the collection and are sold on a bonding curve, with the liquidity from these sales being used as liquidity for the NFT holders. This allows for easy swapping between NFT positions and enables users to stake, borrow against, and trade their NFTs with ease.

Let’s make NFTs liquid!

GumBall Protocol offers a solution to the lack of liquidity in the NFT market. Each GumBall NFT (gNFT) is minted using the corresponding GBT, which is backed by a liquid asset such as ETH and controlled by a bonding curve. This ensures that each gNFT has a true market value at all times and can be sold instantly for the current market price of the collection. The price of GBT represents the minimum value that is currently available to exit a position.

In contrast, the current NFT market is plagued by a lack of liquidity, making it difficult to determine the true market value of an NFT. Exiting an NFT position often requires a direct sale to a buyer, and current DeFi ecosystems are not well equipped to handle non-liquid assets like NFTs.

*PS - No aridrop confirmation, but you never know what could happen! 🪂

Find out more and test the dapp at gumball.fi!

Disclaimer: The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. The content of this newsletter is solely the opinions of the writers who are not a licensed financial advisors or registered investment advisors. Trading cryptocurrencies poses considerable risk of loss. Authors of this newsletter do not guarantee any particular outcome.

Memes of the Week

Lookin good!

The Pain is Real…

It Was Quite a Week, wasn’t it?

Mr Longtail’s Motivation Corner

Quote and Book of the Week

“If your compassion does not include yourself it is incomplete.”

Jack Kornfield, ‘Meditation for Beginners’

Take a moment and think to yourself: what would I need to feel recharged?

There is no technical device in the world that would be able to work smoothly all the time without any connection to energy source. Think about it: your laptop and smartphone need to be charged every now and then. Your PC, fridge or TV must be connected to the electricity all the time, otherwise they just wouldn’t work.

Same with humans. We can run for a crazy long periods of time on a low energy level. “Just one more project to do”, “just one last email”, “just one call and I can relax”. And in reality, it’s an never-ending story. When we ourselves won’t make boundaries in our lives, we will be doing hundred things at once until death.

So how to stop this vicious cycle?

Well, sometimes life just gets very hectic. Maybe we are changing jobs, starting a new business, or buying and arranging a new house that we will soon move into? Or sometimes, we are doing all those things at once. Accepting that things can get hard is the first step. But then, we must set a deadline when exactly the chaos will end. It might be in one month or couple of months.

And then, as a third step, we need to plan a chaos detox. It might be a short trip, it might be a weekend in spa, might be a sport event. Something that we will be looking forward to and that will help us survive the craziness.

I hope that helps! Please share in the comments if you have some tips for recharging your batteries!

Disclaimer: The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. The content of this newsletter is solely the opinions of the writers who are not a licensed financial advisors or registered investment advisors. Trading cryptocurrencies poses considerable risk of loss. Authors of this newsletter do not guarantee any particular outcome.

Interested in advertising on the Longtail Report?

Contact us at: longtail.report@protonmail.com

We’ll get back to you asap!