Issue #1 - Welcome to Longtail Report!

2023 is here. Let's make the most of it.

Finally. All emails sent, comfy clothes on, hot beverage ready to soothe the soul (IYKYK). It’s Friday and from now on this also means…Longtail Report is here!

Enjoy some me time with the best weekly crypto newsletter while you relaxing after stressful week!

Introducing: Mr. Longtail

Mr. Longtail is a motivated, goal-oriented mouse, grinding his way to financial independence. Being a proud owner of crypto portfolio, Mr. Longtail is passionate about the markets, future of finance and all things business.

Don’t be fooled by his small posture, he has everything it takes to succeed. The grit of samurai, the brains of Einstein, and the mindset of Buddhist monk.

Citizen of the world, if you will, Mr. Longtail knows the deepest canals in Amsterdam, the fanciest lofts in Manhattan and the concrete apartment blocks in Eastern Europe.

In bull market he loves designer loafers and summers in Portofino. In bear market he appreciates the simple life - McDonald’s and GeoGuessr.

Mr. Longtail invites you to take a glimpse into his world with the intention of making your week better. He and his talented team gathered all the exclusive information especially for you. Let’s dive in!

Mr. Longtail’s Diary

Dear Readers,

It is with my greatest pleasure to present you the very first issue of Longtail Report- the best, in my humble opinion, weekly crypto newsletter. Longtail Report keeps you informed, entertained and motivated.

In this small (but nevertheless meaningful) section, I will be sharing with you my sophisticated, chaotic, and cutting-edge experience called life of a crypto investor.

Join me in this journey and let’s hodl our hands together!

With warm regards,

Mr. Longtail

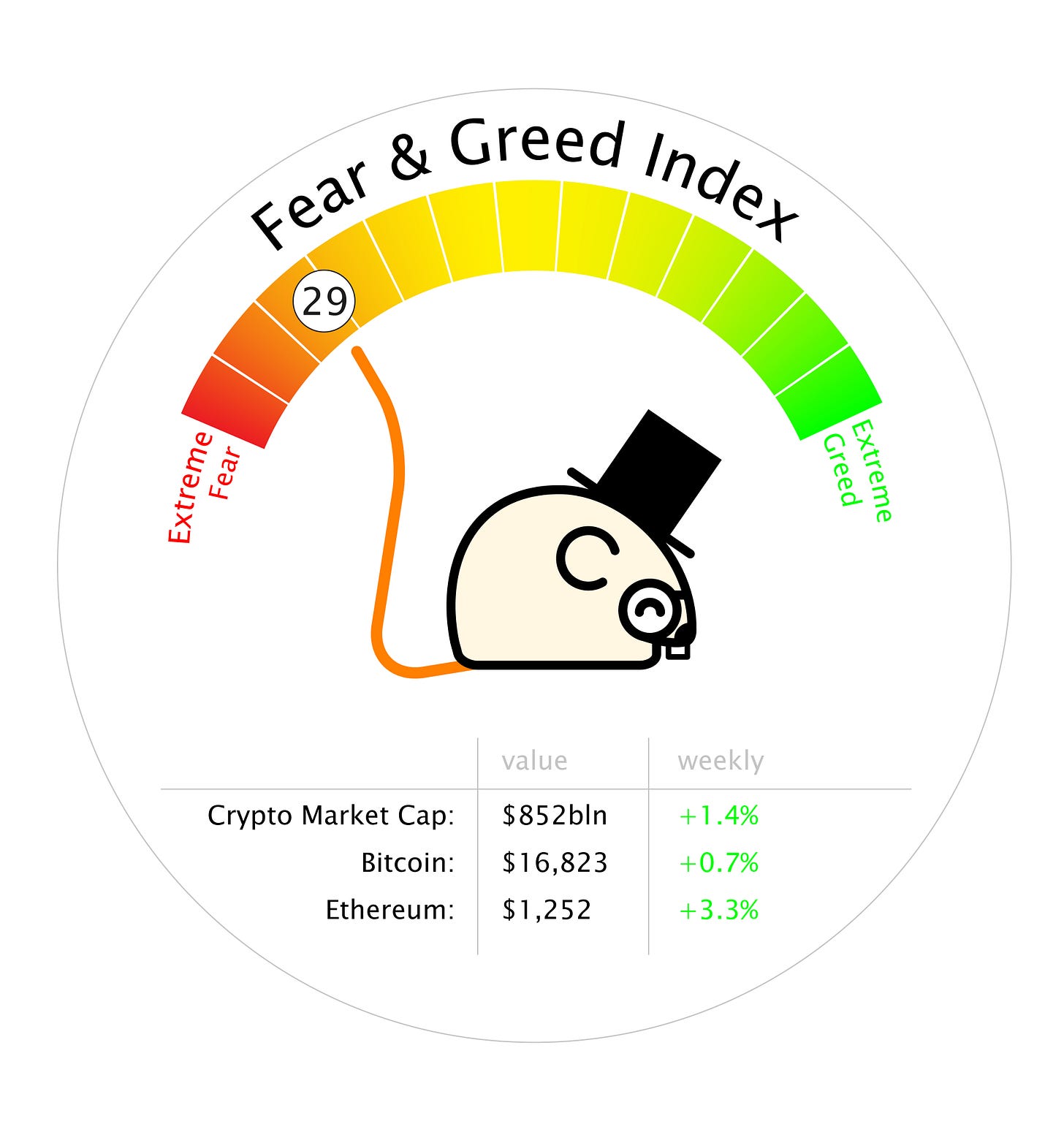

Market Outlook

Prediction for 2023: Genesis Files Bankruptcy Protection in Early January Contributing to Bitcoin Bear Market Lows

Market analyst Bob Loukas plans to add his final tranche early January, which will complete his purchases of bitcoin for this cycle. In his opinion, market bottom would be around the first quarter of 2023. Find out more in the tweet thread below:

Latest News

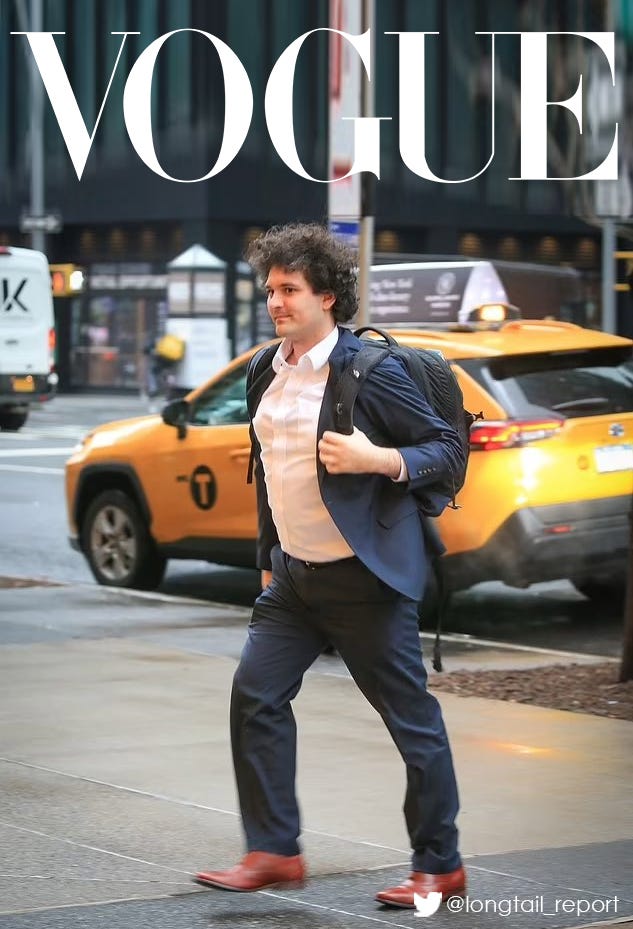

SBF Pleads Not Guilty

Keeping up with the Bankmans-Frieds Season 2 Episode 1 – The Trial

Equipped with a mysterious backpack worn over a formal suit (fashion statement alert), Sam Bankman-Fried pleaded not guilty to criminal charges in Manhattan federal court this Tuesday. Federal prosecutor Danielle Sassoon stated that the evidence against SBF is solid and hence, over hundreds of thousands of documents will be submitted to the defense in the course of the next few weeks.

Contrary to their former boss, Caroline Ellison and Gary Wang pleaded guilty and are now cooperating with the prosecution.

Find out more at Reuters.

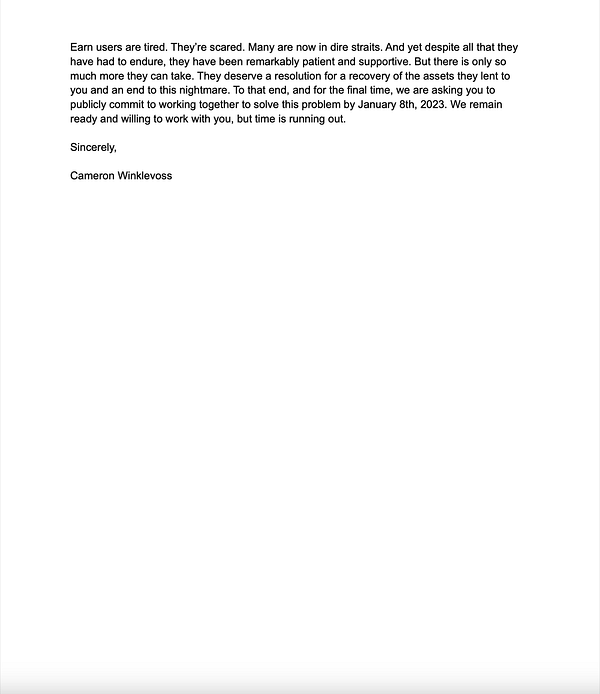

Gemini’s Cameron Winklevoss Gives DCG’s Barry Silbert One Week to Fill up a $1 Billion Whole

In an open letter published on Twitter (aka: ancient Greek agora 2.0), Cameron Winkelvoss points out that the DCG users ‘deserve a resolution for a recovery of the assets they lent to you (Longtail Report: to DCG) and an end to this nightmare’. He proposes the January 8 as the deadline ‘to solve this problem’ and is willing to cooperate with Silbert.

Replying in a comment, DCG founder denies borrowing $1.675 bilion from Genesis.

So, if you fancy some Real Housewives Reunion drama but crypto version, check out the comments section on Twitter!

Another Crypto Market Implosion? DCG and Genesis about to Go Bankrupt?

Following on the news above, we stay in the DCG and Gemini universe for a minute as it seems a lot is going on there.

In the event of bankruptcy, DCG could be forced to liquidate its cash cow: Grayscale Bitcoin Trust (GBTC), which currently holds 634,000 BTC ($10.5B), that could be liquidated, putting massive selling pressure on the Bitcoin price.

Find out more at The Crypto Basic.

Sushiswap Shutters Its Money Market and Launchpad Products to Focus Fully on Dex

Kashi - the lending platform, and Miso - the launch platform will be depreciated due to lack of resources and design flaws. Both services didn’t get market traction or achieved any significant product market fit.

Find out more in Sushi’s CTO Matthew Lilley’s tweet (and we agree with him that every setback is a learning curve):

Is the Bottom Already in? Wall Street Journal’s Article Might Be a Sign We All Were Waiting for

‘Some novices who took up trading during the pandemic are abandoning the hobby. Their loved ones are breathing a sigh of relief.

Spouses, parents and other family members who were subjected to one too many play-by-plays of market movements say they are happy to have their loved ones back—and equally glad they no longer have to hear about buzzy stocks or cryptocurrencies.’

Well, well, well…enjoy it while it lasts lol.

Find out more at the WSJ.

Vitalik’s Positive Reflections on 2022

In his recent interview, Vitalik shared some reflections on crypto space in 2022:

‘2022 has been, I think a complicated year (…). A lot of people will remember the year for all of the terrible stuff that’s happened within the crypto space for all of the multi-billion dollar blow-ups, but I think it’s also important to also remember various positive things that crypto has seen, such as The Merge’

Always brings positivity and perspective to the space. That’s why we all love him!

Find out more at Bankless.

Central Banks Buying Bitcoin?

According to the latest Bank for International Settlements Guidelines, starting from 2025 central banks will be able to invest up to 2% of their balance sheets in crypto. This could open a floodgate of cash into the crypto space which would definitely bring some interesting developments.

Find out more in the video from Coin Bureau.

Elon Musk Expects More Market Pain in 2023

Holiday season was the perfect time to catch up on our fav podcasts. On a recent episode of ‘The All-In Podcast’, Tesla and Twitter CEO Elon Musk gave a warning for market participants and investors and shared his predictions for the markets.

‘I would really advice people not to have margin debt in a volatile stock market. And, from a cash standtpoint, keep powder dry’.

Elon’s predictions:

‘My best guess is we might have stormy year to year and a half and things will start to dawn breaks in roughly Q2 2024… that’s like my best guess’.

Find out more in the video fragment from All-in Podcast.

What are your predictions for 2023? Share your thoughts in the comments section and on our Twitter account!

Project Review

(CAUTION: Alpha Leak!)

Perpetual Contracts for NFTs? No Worries - nftperp Got You Covered!

There are several problems with NFT markets right now. We believe that the two main challenges are the following:

Illiquidity - it’s not easy to find a buyer or seller. Which results in a very large spreads!

High barrier to entry for “blue chip” collections such as Crypto Punks or Bored Apes (current price floor approx. $100.000).

Nftperp solves those by creating a perpetual futures exchange for NFTs that tracks the floor price of NFT collections.

They use vAMM (virtual automated market maker) under the hood. TL;DR on vAMM:

no liquidity provider is needed

no order book

one trader’s gain is another trader’s loss

As it’s simply explained in the documentation:

‘For example, Bob owns an ape with a floor price of 100ETH. He wants to lower his downside risk but he doesn’t want to sell his precious ape. He found out about nftperp and opened a 100ETH short position on the exchange.

If the floor price of BAYC drops to 90ETH, his ape is now worth the value of 90ETH but he can now close his short position with a 10ETH profit. Instead of losing 10ETH with the floor price drop Bob can now hedge his position with no value lost’.

This way, Bob is now able to hedge his spot position with nftperp! That sounds like a cool usecase! But, how to make sure that we can avoid any potential market manipulations or how to make it simply unprofitable for the exploitoooors that will try tinkering with the oracle? Looks like nftperp team resolved it as they explain in the technical documentation:

‘Most NFT collections have Illiquid floors and are highly volatile. Moreover, as we have seen in crypto perp markets, derivatives exchanges often grow bigger in volume and liquidity than spot markets. As a result, an unreliable index could increase liquidation risk and become an attractive target for manipulation.

As a risk management strategy, nftperp opts oracle index prices for funding rate calculations — not for liquidations. On top of that, oracle price feeds are TWAP’d in our contracts to further prevent flash attacks on the protocol.

For safety reasons, nftperp will focus on NFT collections such as Bored Ape Yacht Club, where the market cap and network effect are much larger and more challenging for bad actors to exploit.’

NftFi trend is listed by some analysts as a potential next bull market narrative, so it might be wise to keep an eye on projects such as nftperp!

If you’d like to learn more, take part in nftperp trading competition and get a chance of winning the $VNFTP airdrop, check out more at: https://nftperp.xyz/ and join the discord! G’nut!

Disclaimer: The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. The content of this newsletter is solely the opinions of the writers who are not a licensed financial advisors or registered investment advisors. Trading cryptocurrencies poses considerable risk of loss. Authors of this newsletter do not guarantee any particular outcome.

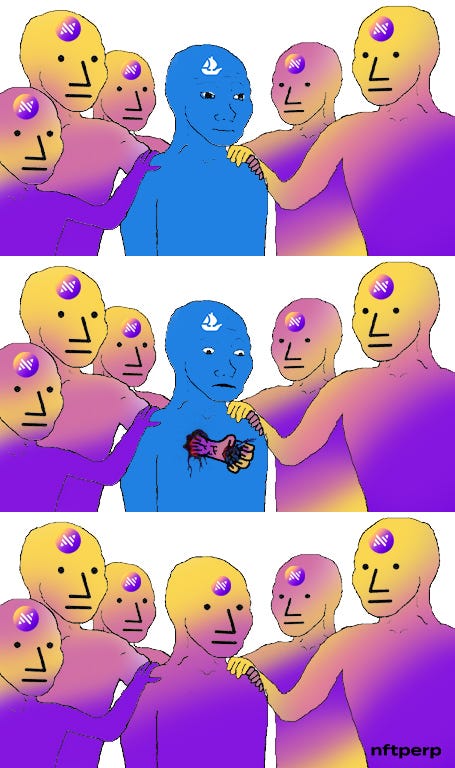

Memes of the Week

We would pick SPF over SBF any day of the week!

Bull Market… Those were the days…

When the meme becomes reality…

Mr Longtail’s Motivation Corner

Quote and Book of the Week

‘The point is not what we expect from life, but rather what life expects from us’

Viktor Frankl, ‘Men’s Search for Meaning’, available at: Amazon

The concept expectations vs reality is often used in memes. It truly shows how powerful expectations are for human beings. Being a mouse myself, I am not in a position to question this paradigm, however, as a certified motivational coach (gotta have a side hustle), I can perhaps offer you an uplifting interpretation of the quote above.

What makes human beings (and some small rodents) unhappy is a constant disappointment that their expectations towards other people and life have not been fulfilled.

‘The job at this law firm is horrible, nothing as it seemed during the interview’, ‘my girlfriend is working too much, she is not that fun as I expected’, ‘my neighbours are not that nice as I thought’, ‘my husband is not as ambitious as I imagined him to be’.

This thinking creates a sort of chain of expectations: someone expected something from us we didn’t want and now we do the same with people in our life.

What is the common thing of all those remarks? The focus is always on something or someone else, never on the person saying it. What would happen if, instead of expecting from others, we would start look into ourselves? Be brutally honest. It might be that actually, we would like to be more fun or more ambitious. It might be, that this job is objectively not bad, but we do it because our parents expected us to be a lawyer.

There is no doubt 2022 was a challenging year, both for the world (war in Ukraine), and for the crypto community. Collapse of Terra Luna, 3AC, Celsius, BlockFi, Alameda and FTX profoundly disrupted the past twelve months. The fact that we are all deeply affected by those events stems from our unmet expectation of the past year: we all thought 2022 would be better than it actually was.

Now, what we can do now to improve the quality of our human (and small rodent) existence?

The answer is: expect more from yourself, even if it sounds counterintuitive. It’s tough already, I know. But putting a bit of good old-fashioned pressure on ourselves to be more healthy, more optimistic, more productive, more focused, and last but not least- more understanding and positive towards others, will benefit us in a way that we wouldn’t even know it’s possible.

Right now, life expects from us to be patient, creative, motivated and determined to make our personal, professional, financial and health goals a reality. Let’s show that we can deliver. Upon fulfilling expectations we had for ourselves, we will be truly satisfied.

Disclaimer: The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. The content of this newsletter is solely the opinions of the writers who are not a licensed financial advisors or registered investment advisors. Trading cryptocurrencies poses considerable risk of loss. Authors of this newsletter do not guarantee any particular outcome.

Interested in advertising on the Longtail Report?

Contact us at: longtail.report@protonmail.com

We’ll get back to you asap!