Crypto Stays Strong Amidst the Chaos

The Latest Developments

Mr. Longtail’s Diary

Dear Readers,

Don’t we all want the chaotic times for crypto community to finally end? However, as this week’s Motivational Corner reminds us, chaos creates opportunity.

So let’s dive in and see what’s up in the crypto world!

P.S. Please note that from now on, you will have your favourite crypto newsletter on Mondays. The new schedule will help you start your week energized and well-informed!

All the best,

Mr. Longtail

This week’s tasty snacks:

🧀 - Market Outlook

🧀 - Hot News: Crypto Resilient Amidst the Latest SEC Scrutiny

🧀 - Project Review: Eigen Layer: Staking On Steroids!

🧀 - Those Sweet, Sweet Memes!

🧀 - Your Favourite Motivation Corner!

Market Outlook

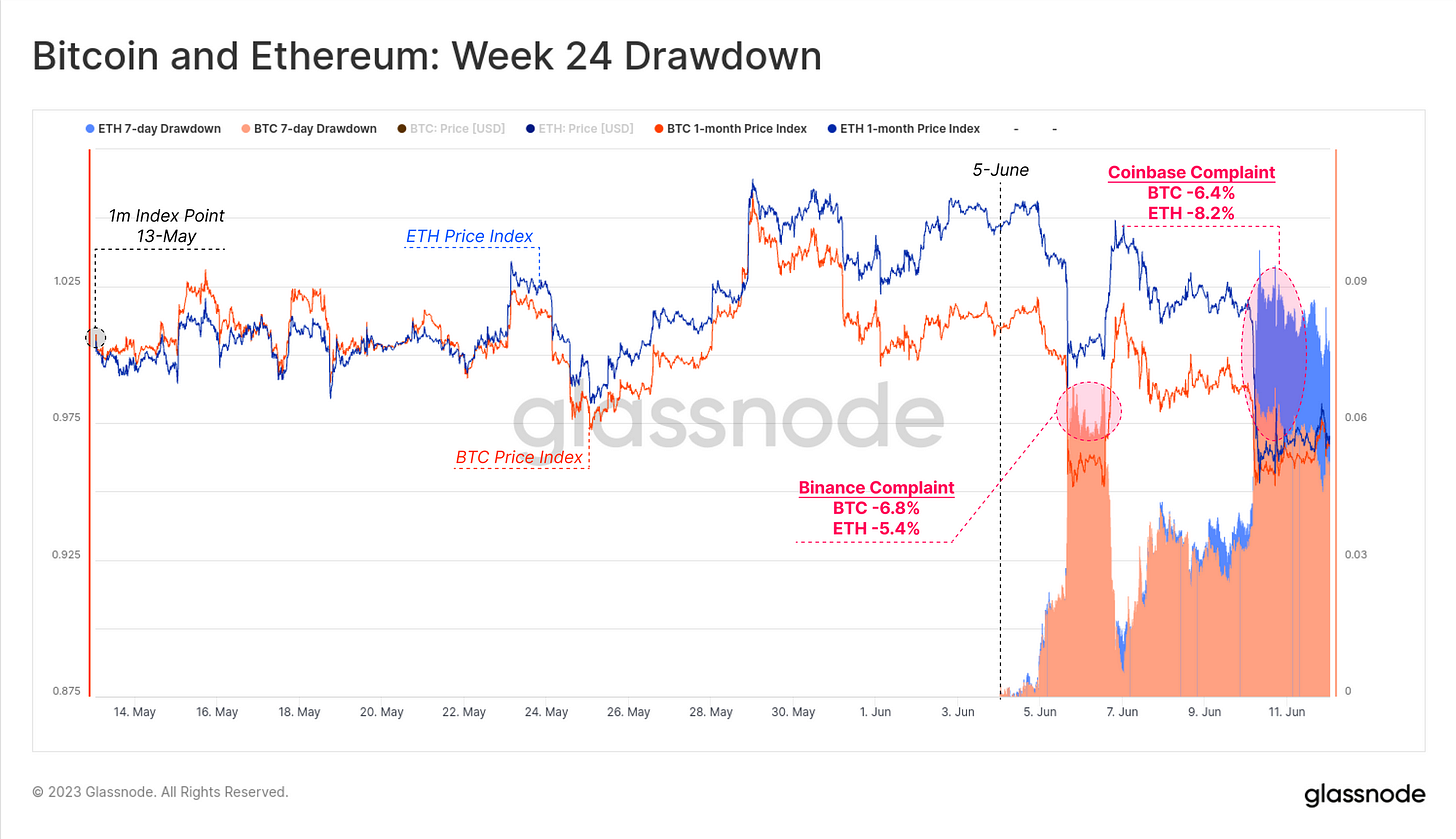

In a tumultuous week for digital asset regulation, the US SEC charged Binance and Coinbase for securities violations. The charges involve listing unregistered securities and violating securities laws with earn and staking services. Binance faces additional allegations of wash trading and commingling customer funds. The news led to a market decline, with ETH down 5.4% and BTC down 6.8%. ETH further dropped by 8.2% by the end of the week. We'll focus on the investor response by analyzing exchange activity for any negative sentiment shifts.

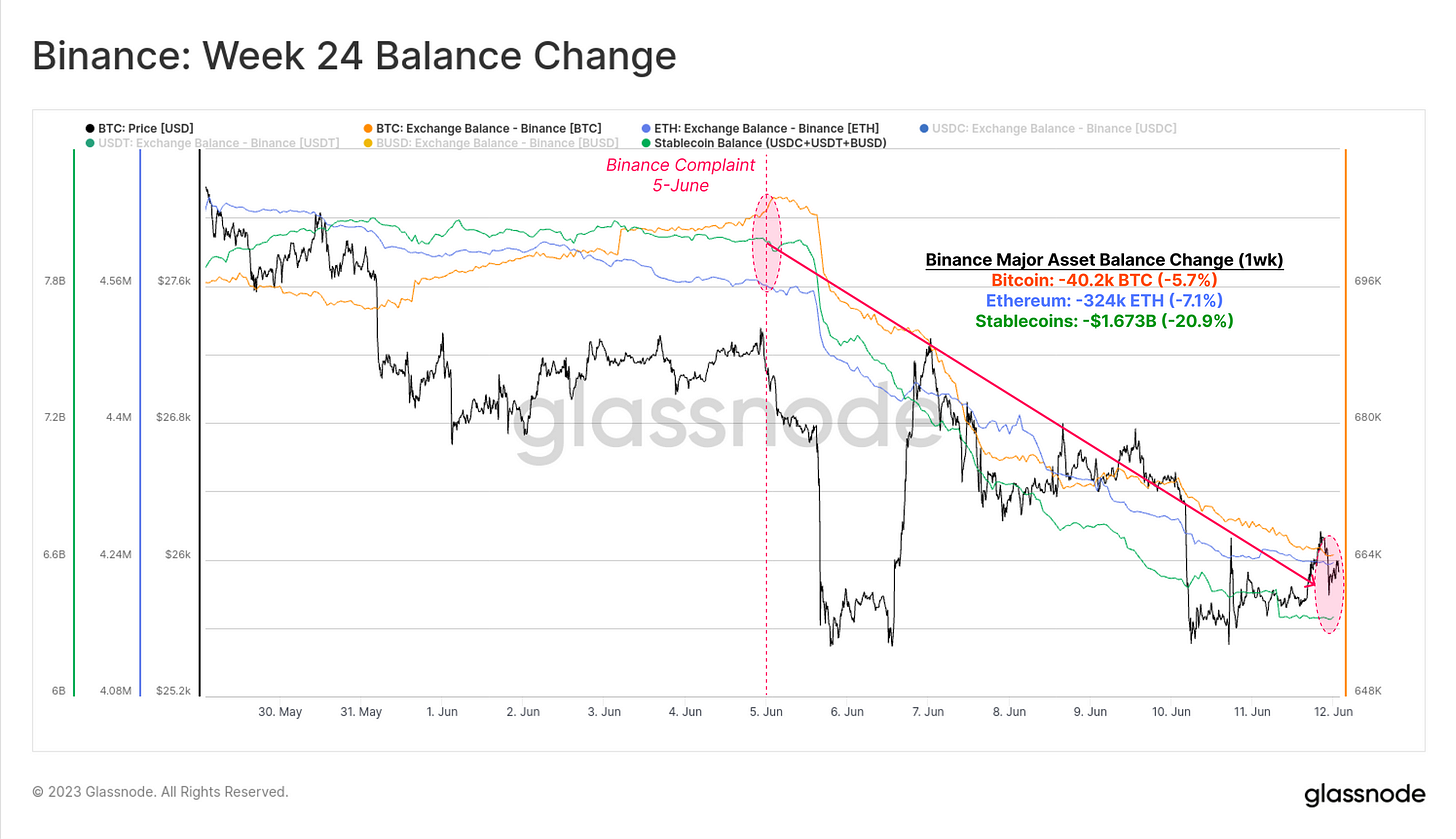

Binance witnessed significant coin outflows following the recent headlines. Over the past week, investors steadily withdrew assets, resulting in a 20.9% decrease in aggregate stablecoin balances (over $1.6 billion). BTC and ETH reserves also declined, albeit less drastically (5.7% and 7.1% respectively).

It's worth noting that Binance still holds substantial BTC and ETH reserves, but its stablecoin reserves have plummeted by 75% since November 2022, primarily due to prior SEC complaints against BUSD.

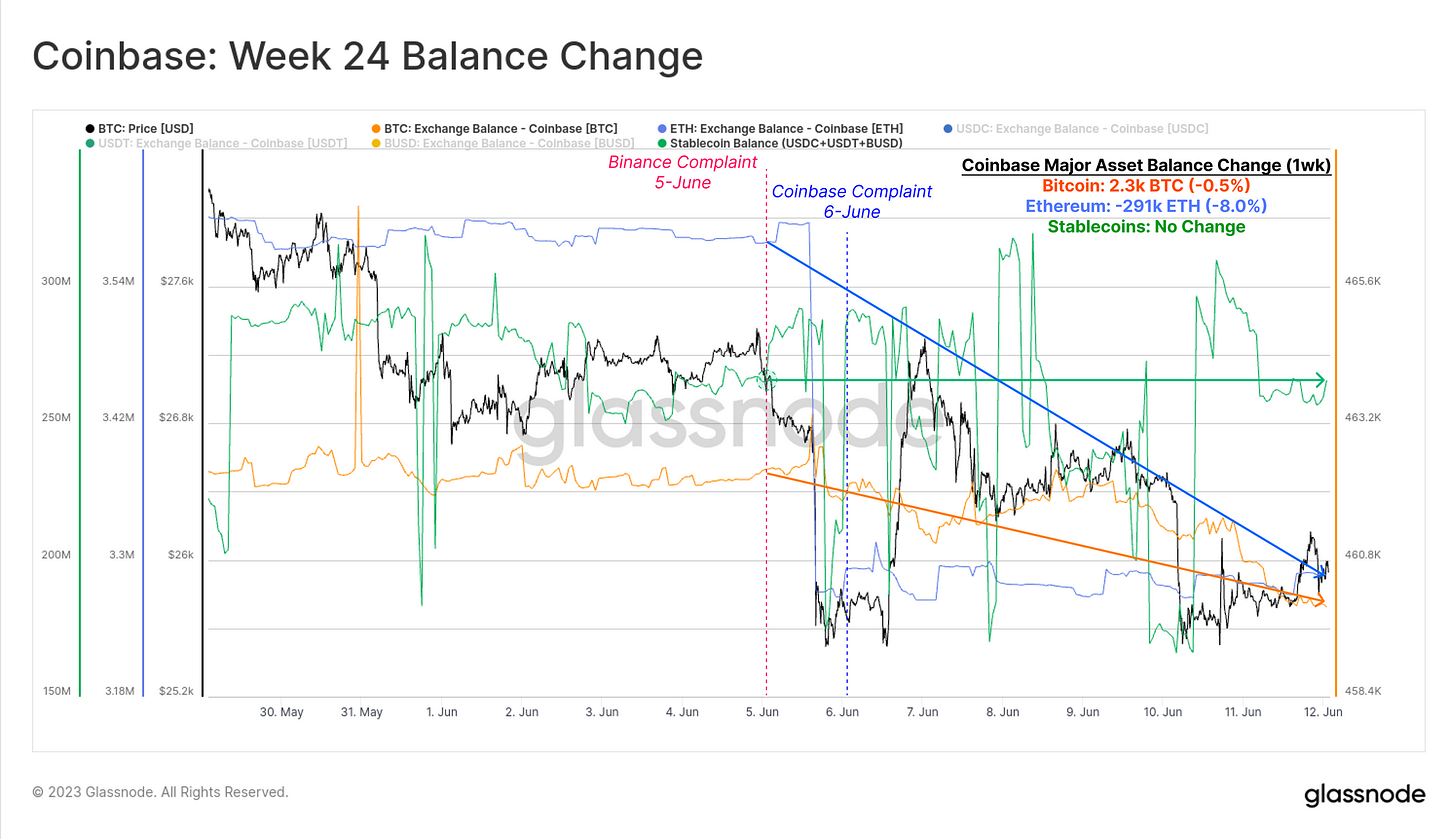

In comparison, Coinbase experienced relatively minor changes in net reserves. Stablecoin balances remained stable, while BTC balances decreased by 2,300 BTC (0.5% of total). However, there was a significant decline of 291,000 ETH (around 8% of total balance), indicating a stronger response from investors, potentially related to concerns about Coinbase's staking services.

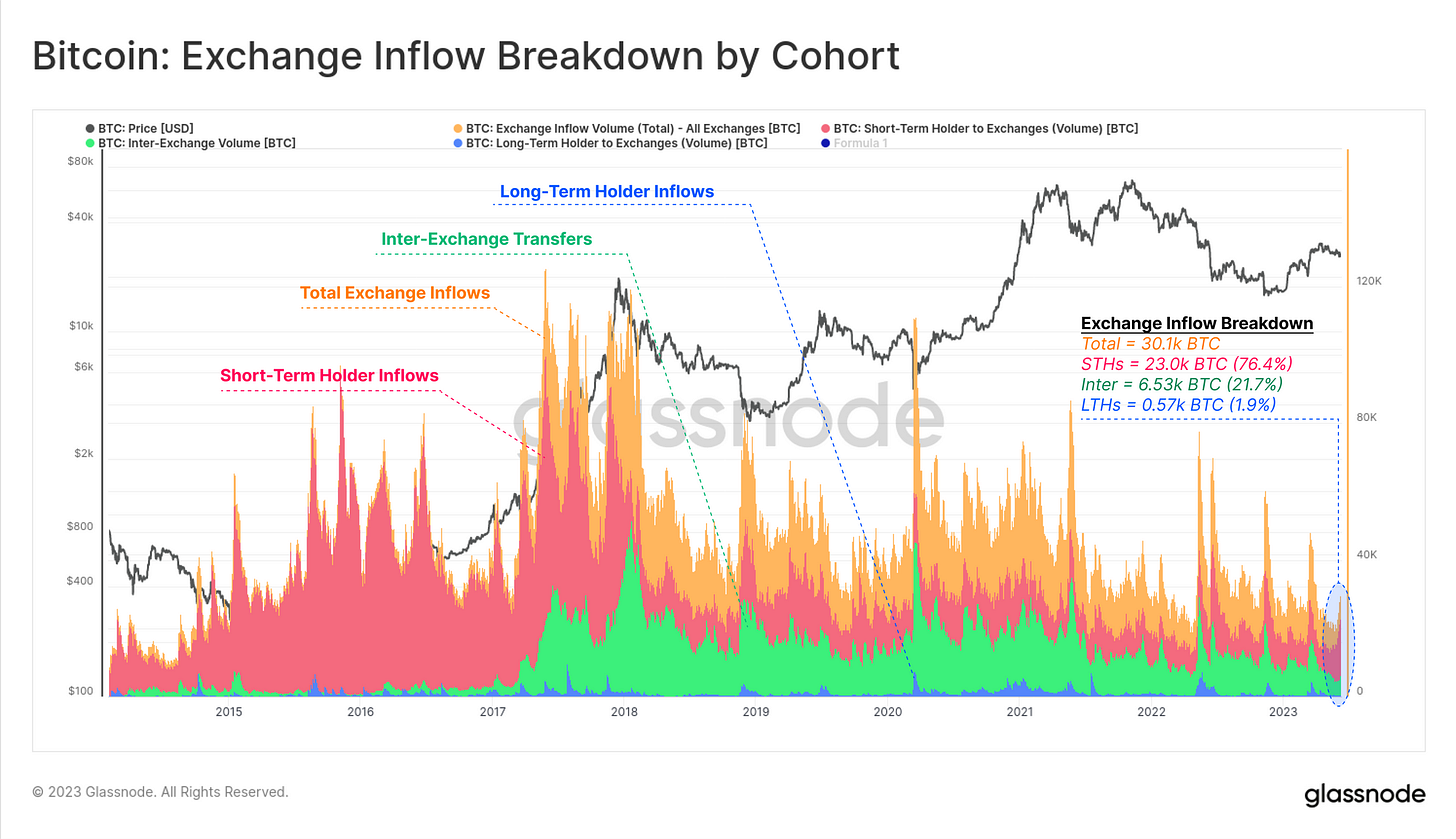

Analyzing aggregate deposit volumes reveals distinct investor groups and their reactions to the news:

🔴 Short-Term Holders (STHs) represent 76.4% of deposit volume (23.0k BTC)

🔵 Long-Term Holders make up only 1.9% of deposit volume (570 BTC)

🟢 Inter-Exchange Transfers account for 21.7% of deposit volume (6.53k BTC)

Historically, STHs contribute around 60% of deposit flows, indicating that recent buyers have been the most active this week. Inter-exchange flows typically make up about 35%, suggesting that investors on the margin prefer self-custody rather than transferring coins to other exchanges.

US regulators continue to display hostility, charging major exchanges Binance and Coinbase. Customers have shown concern, leading to declines in asset balances on these exchanges. However, these declines are within typical patterns, and the reaction from long-term holders suggests limited surprise. Many recent BTC buyers have sent their coins to exchanges, possibly for sale, to reduce risk. It remains to be seen how investors will respond as the lawsuits unfold.

Read more at Glassnode

Disclaimer: The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. The content of this newsletter is solely the opinions of the writers who are not a licensed financial advisors or registered investment advisors. Trading cryptocurrencies poses considerable risk of loss. Authors of this newsletter do not guarantee any particular outcome.

Latest News

Crypto Resilient Amidst the Latest SEC Scrutiny

Bitcoin's resilience in the face of regulatory scrutiny and market challenges has prevented a significant dip in its price. Despite U.S. regulators targeting major crypto exchanges and labeling several altcoins as securities, Bitcoin has managed to open the Asia trading week with a modest 0.4% increase, reaching $25,912. In contrast, Ether has experienced a slight decline, currently valued at $1,748. Despite the difficulties, Bitcoin has displayed resilience, with limited selling interest observed for both Bitcoin and Ether.

Joe DiPasquale, from BitBull Capital, highlighted that Bitcoin's support level at $25,000 is holding up reasonably well.

Read more at Coindesk

Hack on Venus Protocol

Venus Protocol, an integral part of the BNB Chain ecosystem, is currently facing a critical situation involving a significant Binance Coin (BNB) loan position owned by a hacker. The hacker, responsible for executing a massive breach on the BNB Chain in October last year, has utilized Venus Protocol to borrow stablecoins amounting to $150 million.

The hacker managed to leverage their stolen BNB to secure a loan, which has resulted in a substantial position of 900,000 BNB, equivalent to approximately $210 million.

The BNB Chain team wants to take control of the position if the price of BNB reaches the liquidation threshold to minimize the potential adverse effects on the market.

Read more at Theblock

Bitcoin and Ether Reserves Decline

According to a research report from CryptoQuant, U.S.-based exchanges have witnessed a decline in the amount of Bitcoin they hold on behalf of their customers. This drop has led to U.S. exchanges being surpassed by offshore and international exchanges in terms of custodial Bitcoin amounts. The report highlights that Bitcoin reserves on U.S.-based exchanges are currently at their lowest level since January 2017.

The decline in crypto reserves suggests that users may be withdrawing their holdings from these exchanges. This withdrawal trend could be attributed to concerns over security or a preference for holding funds in private wallets, where users have more control over their assets.

Read more at Theblock

Users Are Leaving Centralised Exchanges

The Legitimate Volume Index from The Block Research shows a significant drop in trading volumes on centralized exchanges during the month of May. The total trading volume recorded for the month amounted to $307.4 billion, representing a substantial decline of 23.2% compared to April. This figure also marks the lowest monthly trading volume observed since November 2020.

The declining trading volumes suggest that users are increasingly moving away from centralized exchanges, potentially seeking alternative trading venues or adopting different strategies for their cryptocurrency holdings. This trend can be seen as a response to the regulatory uncertainties surrounding centralized exchanges and a desire for more control over their digital assets.

Read more at: Theblock

Binance CEO Changpeng Zhao Replies to Allegations

Analytics platforms Nansen and DefiLlama have recorded notable increases in exchange outflows from Binance over the past week, following the news of the Securities and Exchange Commission's lawsuit against the company.

Nansen's data reveals a net outflow of $2.36 billion from Binance during the seven-day period, accompanied by an additional $123.7 million flowing out of Binance.US. Meanwhile, DefiLlama reports a more substantial figure of $3.35 billion in outflows from Binance. Glassnode data highlights a 5.7% decline in Binance's BTC balance, amounting to approximately $1 billion, over the same seven-day period.

Binance CEO Changpeng Zhao suggests that there may be alternative interpretations of the outflow data. While acknowledging the increased outflows, he maintains that these numbers should be analyzed in the broader context of Binance's overall operations and user base.

Read more at: Cointelegraph

Project Review

Eigen Layer: Staking On Steroids!

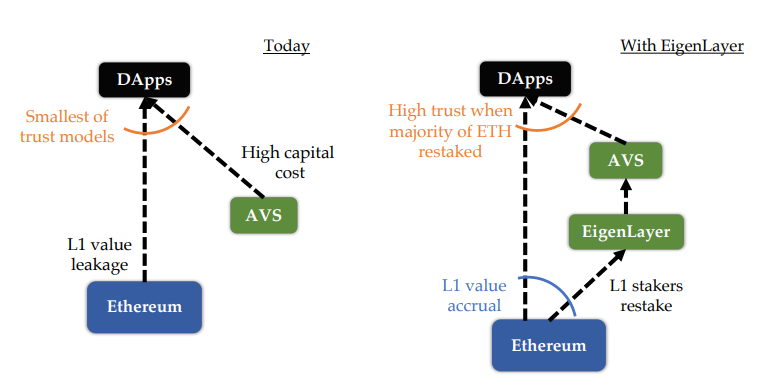

EigenLayer is an Ethereum protocol that introduces a new cryptoeconomic security primitive called restaking. This protocol enables users to restake their ETH, extending security to additional applications on the network.

Summary: EigenLayer is built on Ethereum and introduces restaking as a new primitive in cryptoeconomic security. Users who stake ETH can choose to restake it through EigenLayer smart contracts, providing security to more applications on the network. EigenLayer's potential lies in aggregating and extending cryptoeconomic security by enabling restaking and validating new applications on Ethereum.

Overview: Cryptoeconomic security has been a challenge in Web3, and fragmented security is a particular issue on the Ethereum network. Middleware and non-EVM applications on Ethereum generate their own trust networks, which is inefficient and resource-intensive. EigenLayer addresses this by introducing the restaking primitive. Users can repurpose their staked ETH to extend security to other applications. EigenLayer acts as a middle layer where users grant additional enforcement rights to restake their ETH on other applications. This opt-in feature introduces slashing conditions that persist above the consensus layer, allowing for extensible security. EigenLayer can restake ETH on additional applications while enforcing honest behavior and disincentivizing malicious behavior through slashing conditions. In this way, staked ETH can provide validation services beyond Ethereum itself.

Cool project, huh? Well… There might be some responsibilities coming your way…🪂

Step-by-Step Guide to Restaking on EigenLayer Testnet:

Visit the EigenLayer testnet page.

Connect your Metamask wallet.

Change the network to Goerli.

Obtain stETH and rETH tokens.

Get Goerli ETH from this faucet.

Send Goerli ETH to the Lido's stETH token contract address "0x1643E812aE58766192Cf7D2Cf9567dF2C37e9B7F". You will receive Lido's stETH automatically after the transaction is complete.

Visit the Rocket Pool testnet page and stake your Goerli ETH to obtain Rocket Pool's rETH.

Now you have both Lido's stETH and Rocket Pool's rETH testnet tokens.

Return to the EigenLayer testnet page.

Select "Rocket Pool ETH" and stake your rETH.

Select the "Lido Staked Ether" pool and stake your stETH.

For more information about the testnet, refer to this article.

Please note that EigenLayer does not have its own token yet, but there is a possibility of launching one in the future. Early users who have completed the testnet actions may be eligible for an airdrop if EigenLayer decides to launch their own token.

It's important to note that there is no guarantee of an airdrop or the launch of EigenLayer's own token. This is purely speculative.

Please proceed with caution and stay updated on any announcements or developments from EigenLayer. Read more at: Eigenlayer

Disclaimer: The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. The content of this newsletter is solely the opinions of the writers who are not a licensed financial advisors or registered investment advisors. Trading cryptocurrencies poses considerable risk of loss. Authors of this newsletter do not guarantee any particular outcome.

Meme of the Week

Mr Longtail’s Motivation Corner

Quote and Book of the Week

‘In the midst of chaos, there is also opportunity’. - Sun-Tzu

‘Principles’ by Ray Dalio

By recognizing the potential opportunities that can arise from chaos and approaching it with the right mindset, we can navigate uncertain times more effectively while embracing new possibilites.

Embracing Change: Chaos is usually preceded by big changes. However, when we are open to change and adaptable can find innovative solutions or create new paths to success.

Creative Problem-Solving: When faced with disorder or uncertainty, we have the opportunity to think outside the box, explore new perspectives, and challenge the status quo.

Market Disruption: Chaotic periods can create disruptions in the market or industry, opening up opportunities for new entrants or for established players to reinvent themselves.

Personal Growth: When faced with adversity or uncertainty, we definitely struggle. Nevertheless, these difficult experiences can shape our character and expand our capabilities.

Systemic Change: Chaotic periods can also create an impetus for broader societal or systemic change. Thus, they can be catalysts for progress and a reimagining of existing systems.

Disclaimer: The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. The content of this newsletter is solely the opinions of the writers who are not a licensed financial advisors or registered investment advisors. Trading cryptocurrencies poses considerable risk of loss. Authors of this newsletter do not guarantee any particular outcome.

Interested in advertising on the Longtail Report?

Contact us at: longtail.report@protonmail.com

We’ll get back to you asap!