Crypto Narratives for 2023

Which Sectors Will Mint Future Crypto Millionaires?

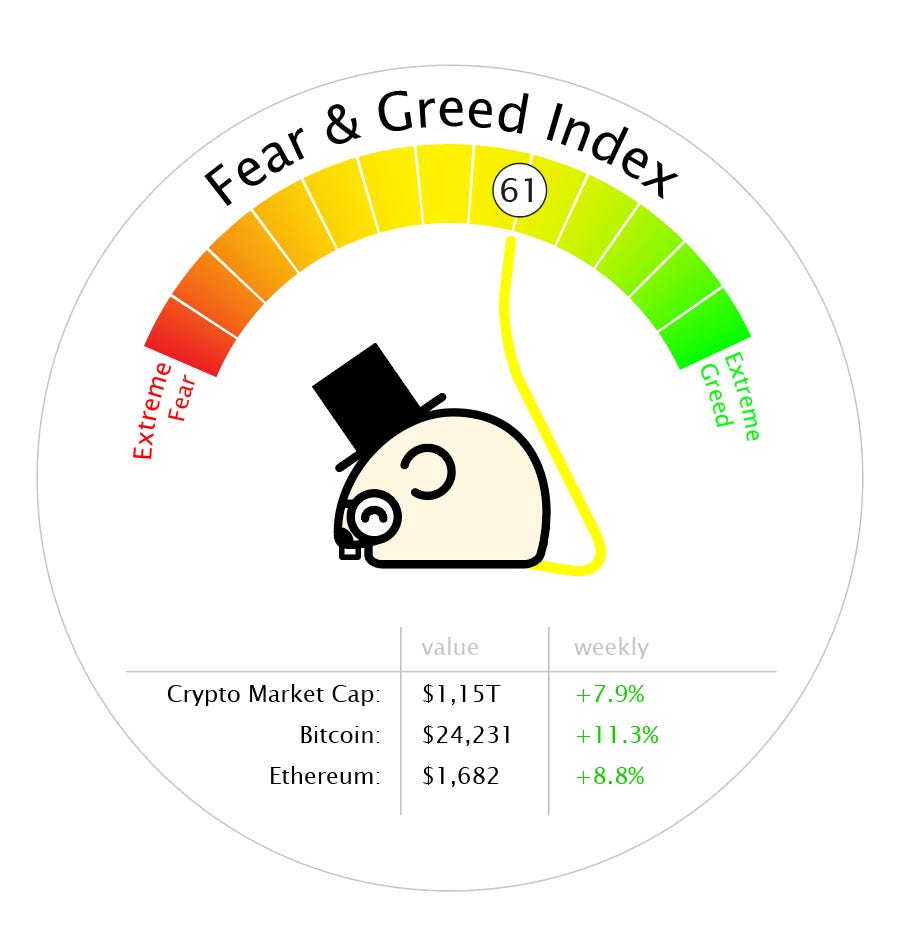

Mr. Longtail’s Diary

Dear Readers,

Here is your favorite mouse dedicated to bringing your the most relevant crypto news & trends. Every week on Friday, carefully curated just for you.

As you all, I am waiting for the magical bull market, when I will regain respect from my friends and family. Meanwhile, let’s dive into the crypto market and see what’s up because portfolio won’t grow itself!

Take care,

Mr. Longtail 🐭

This week’s tasty snacks:

🥬 - Market outlook: Crypto Narratives for 2023!

🧀 - Hot News: Binance moving 400mln$, SEC vs. Kraken, Ethereum Shanghai Explained

🧀 - Project Review: Koru DAO: The Decentralized Social Media Experiment

🍰 - Those sweet, sweet memes!

🍓 - Your favourite motivation corner!

Market Outlook

Crypto Narratives for 2023!

2022 was the roughest year in the history of crypto. Megalomaniacs like SBF and Do Kwon stole the spotlight. Everyone has been paying attention to them, but it's important to weed out these toxic characters. However, it shouldn't take us away from the potential, and the core crypto thesis remains unchanged. In 2023, these are the 9 narratives that we should be paying attention to:

1. Tokenizing Real World Assets

In order to mature as an industry, we need to integrate with the "real world." Tokenizing real-world assets unlocks cashflow that's not affected by crypto's volatility. Real estate, art, loyalty programs, and more can benefit from transparency, capital efficiency, and improved liquidity. MakerDAO, Centrifuge, Maple Finance, and Goldfinch are some of the projects that have made meaningful progress in this area.

2. AI

The convergence of cryptocurrency and artificial intelligence (AI) is a captivating domain of advancement. The emergence of blockchain technology and the ascent of decentralized finance (DeFi) have opened up novel possibilities for AI to facilitate crypto transactions that are more efficient and secure. Projects such as AGIx, OCEAN, FET, NMR or RLC could potentially do well if they reach adoption.

Even though a huge chunk of the AI coins is a cash grab, we belive it will be an interesting sector with a lot of innovation.

3. NFT Financialization

NFTs are going to be a multi-billion dollar asset class, but that asset class will need financial plumbing. DeFi x NFT is about unlocking NFT's liquidity and turning them into productive assets. Nftperp and Insert Finance are some of the projects leading the next wave of NFT financialization.

4. Zk-rollups

Zk-rollups will enable dApps that were previously impossible. Important projects to watch include Scroll, zkSync, Starkware, Aztec Network, and Polygon Miden & Hermez. Many consider zk-rollups to be the superior tech, but due to the technical complexity, it will take years for zkRollups to be fully deployed and mature.

5. Arbitrum

Arbitrum (Optimistic rollup) is crushing it now, and every new DeFi innovation is happening here. All the TVL from VC layer 1 chains keeps migrating towards Arbitrum. You can participate in Arbitrum Odyssey, use various dApps to get an airdrop one day, or keep an eye on new protocols launching.

Celestia is the first modular blockchain, and you can think of it as the Amazon Web Services of blockchain. It will lower security costs and make launching a blockchain as simple as a smart contract. And these blockchains will be customizable and sovereign.

6. The Perps War

Decentralized perps found product/market fit last year, and FTX's death gave it a rocket boost. Although it feels saturated as a DeFi degen, they've barely penetrated the market. Important protocols to watch include dYdX, GMX, Gains Network, Kwenta by Synthetix, Perpetual Protocol, and Futureswap.

7. Metaverse

The metaverse is not just a game; it's a social experience that mirrors the real world. Blockchain will play a key role in the metaverse, as it will bring security, interoperability, and asset ownership to this new realm.

8. Cross-chain Bridges

Cross-chain bridges are the key to unlocking the full potential of blockchain. Bridges allow assets to flow freely between different blockchains, unlocking new possibilities for DeFi and NFTs.

9. DAOs

A DAO (Decentralized Autonomous Organization) is a type of organization that operates on a decentralized network, typically a blockchain. It is run through a set of rules encoded as smart contracts, which allow for decision-making and management of funds without the need for a central authority. In a DAO, members have a say in decision-making and can vote on proposals that determine how the organization functions. DAOs can be used for a variety of purposes, such as managing decentralized funds, creating decentralized applications, or governing decentralized networks. We expect a lot of innovation on the side of DAOs.

Disclaimer: The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. The content of this newsletter is solely the opinions of the writers who are not a licensed financial advisors or registered investment advisors. Trading cryptocurrencies poses considerable risk of loss. Authors of this newsletter do not guarantee any particular outcome.

Latest News

Binance moving 400mln$

Reuters has reported that Binance, the global cryptocurrency exchange, had secret access to a bank account belonging to its purportedly independent US partner, BAM Trading, and transferred over $400m from the account to a trading firm managed by Binance CEO Changpeng Zhao.

The transfer of funds from BAM Trading's account at California-based Silvergate Bank began in late 2020, according to company messages. It is unclear whether any of the money belonged to Binance.US customers, and the report has raised concerns that the global exchange is controlling the finances of Binance.US.

Find out more at Reuters

SEC going after Do Kwon

The U.S. Securities and Exchange Commission (SEC) has accused stablecoin issuer Terraform Labs and its founder Do Kwon of transferring over 10,000 bitcoin worth millions of dollars to a Swiss bank account following the enterprise's collapse in May last year.

The SEC has filed a suit against the company and Kwon for misleading customers on several issues, including the sale of unregistered securities. The complaint alleges that Terraform and Kwon transferred bitcoin from platform accounts to an un-hosted wallet and then to a Swiss bank where it was converted to cash. Since June 2022, over $100 million has been withdrawn from the Swiss bank account.

The collapse of Terraform Labs wiped out over $40 billion in combined market value, and authorities in South Korea have frozen funds suspected to be tied to Kwon.

Find out more at CoinDesk

Ethereum Shanghai Upgrate Explained

The Ethereum Shanghai upgrade, also known as the Ethereum Shanghai fork, is a significant upgrade to the Ethereum blockchain that is expected to take place around mid-March 2023. This upgrade will roll out five Ethereum Improvement Proposals (EIPs), with EIP-4895 likely to be the most prominent one. This EIP will allow users to withdraw staked Ether (ETH) and unlock their staked Ethereum, which has been locked for around two years since the staking market emerged.

The upgrade is expected to have economic implications for various stakeholders, including Ethereum users, traders, and investors. For Ethereum users, the Shanghai upgrade aims to address some of the long-standing issues of poor user experiences, high gas fees, and slow transactions. The upgrade will introduce EIP-3855, which should help improve transaction speeds, and EIP-3860, which hopes to reduce transaction costs. These improvements should help improve network usage across DeFi and NFTs, as some of these ecosystems were affected by high gas fees and slow transactions.

For traders, the Shanghai upgrade could have an impact on price action. The previous Ethereum upgrade in 2022 created good volatility in the market, which traders were able to capitalize on. Ether supplies on exchanges have already started to plunge as investors choose to move their assets to self-custody. With exchange supplies of Ether plummeting fast, traders may see yet another spike in price leading up to the Shanghai upgrade. However, short-term traders might want to note the fall in Ether’s price since the Merge was pushed in 2022. This upgrade may not be too different.

For investors, the Shanghai upgrade has the potential to impact the price of Ether. If some of the 16.4 million ETH staked is withdrawn and hits the market, it could increase the supply of Ether and bring prices down right after the Shanghai upgrade is complete. However, ETH withdrawals will only be available in small chunks, which could mitigate downside risks to Ether prices. Nonetheless, the fear of increased supply is something that could hurt market sentiment in the short term.

In summary, the Ethereum Shanghai upgrade is an important milestone for the Ethereum blockchain, with the potential to improve the user experience, lower transaction costs, and increase the network's overall usage. However, the upgrade could also have short-term economic implications for various stakeholders, with the potential for increased price volatility and downward pressure on Ether prices due to increased supply.

SEC vs. Kraken

The recent settlement between the United States Securities and Exchange Commission (SEC) and crypto exchange Kraken has raised concerns that the regulatory body may be about to launch a wider assault on the crypto industry.

The SEC's action came about because Kraken had sold unregistered investment products, with the returns advertised on staking crypto reaching 21%, the agency said. Critics of the SEC, however, say that registration of staking program securities is more complex than just completing a form on the regulator's website.

The SEC's actions against Kraken may have been intended to act as an example to other firms that were promoting staking, but not all industry insiders believe Ethereum and other blockchain networks are in danger.

Gamer who won an NFT tries to sell it for $3.7 million

A gamer won the top prize in Yuga Labs' Dookey Dash game and is now selling the NFT for $3.7 million. The NFT is a key that can be used for a token-gated mission by the Bored Ape Yacht Club and CryptoPunk parent company. Gamers who held Bored Apes’ “Sewer Pass” NFTs were able to play the Dookey Dash video game for three weeks, and the pro Fortnite gamer known as Mongraal won the game, taking the prize.

The NFT is currently listed for 2,222 ETH on OpenSea, with the highest offer being 10% of the proposed price, at 222 ETH.

Find out more at TheBlock

Project Review

Koru DAO: The Decentralized Social Media Experiment

Koru DAO is a revolutionary social media experiment that is owned and controlled by a decentralized autonomous organization (DAO). It is the first social media account that is truly decentralized and DAO-owned. Here’s what you need to know about this exciting project.

Koru DAO is the first social media account that is truly decentralized and DAO-owned. It operates through NFTs that give the holder the ability to post via the shared Lens account @KoruDAO once every 12 hours.

The vision of Koru DAO is to become the largest account on Lens, a social media platform. The more followers Koru DAO receives, the more valuable it becomes. The higher the quality of the Koru DAO content, the more valuable it becomes.

To grow to become the largest account on Lens, NFT holders need to coordinate and post high-quality content that attracts others to follow Koru DAO and join the community.

Koru DAO is built on smart contracts that can evolve over time. Community members can establish a governance structure that prevents spammy or promotional posts from getting through. Only if certain companies pay Koru DAO will they be able to publish a post.

Koru NFTs have utility as they give you the ability to post via the KoruDAO lens account once every 12 hours. Additionally, Koru DAO earns revenue from NFT resales (5% per trade), which the DAO will be able to vote on what to do with.

Koru DAO is an exciting social media experiment that could potentially revolutionize the way social media is owned and controlled. If you're interested in being a part of this groundbreaking project, head over to their Discord!

Find out more at korudao.xyz!

Disclaimer: The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. The content of this newsletter is solely the opinions of the writers who are not a licensed financial advisors or registered investment advisors. Trading cryptocurrencies poses considerable risk of loss. Authors of this newsletter do not guarantee any particular outcome.

Memes of the Week

We All Know They Are Coming To Pump Our Bags!

Why Whales Are Always So Mean???…

Happy Valentines Day!

Mr Longtail’s Motivation Corner

Quote of the Week

„The most important decision you make is to be in a good mood.”

Voltaire

Book of the week

“Becoming Bulletproof: Life Lessons from a Secret Service Agent” by Evy Poumpouras

How to make the decision to be in a good mood? Five easy steps.

The first advice is actually derived from the iconic Sheldon Cooper himself: get yourself a hot beverage. Hot tea or chocolate, s'il vous plaît!☕️

Treat yo self. Order that pizza, buy these shoes. There are days when we need an emotional blanket of safety and security. Sometimes the blanket is free and we can take it from our bed. Sometimes the blanket is more expensive (shoes) or gives us additional calories to deal with later on (pizza).🍕

Take a nap. Sleep is a magical remedy for everything. It clears our mind and strengthens our body. Not feeling great can be cured by some extra hours of sleep.😴

Watch your favorite show. Quite self-explanatory.📺

When you will feel better go back on track! Get back to your healthy eating and working out routine. Remember that a weaker day or even a weaker week doesn’t define you! Life is made of seasons and if you give yourself enough grace, you will have more good seasons than bad.💪

Disclaimer: The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. The content of this newsletter is solely the opinions of the writers who are not a licensed financial advisors or registered investment advisors. Trading cryptocurrencies poses considerable risk of loss. Authors of this newsletter do not guarantee any particular outcome.

Interested in advertising on the Longtail Report?

Contact us at: longtail.report@protonmail.com

We’ll get back to you asap!