Are We In A Bull Market?

Or should we wait a bit longer...?

Mr. Longtail’s Diary

Dear Readers,

Looong time no see! I hope you will forgive me for my absence. Life happened and I found myself in a chaos of moving places.

I would say I definitely upgraded in terms of quality of living. Instead of a small rental pantry that I shared with other, equally competitive mice, I am proud to call myself a pantry owner now. However, the journey to get there has been nothing but humbling and challenging. That being said, I feel #blessed and #grateful that hard work, dedication and sacrifice paid off.

Going forward, my team and I will do our best to never leave you without the Longtail Report for so long!

Let’s manifest the bull market together!💥

This week’s tasty snacks:

🧀 - Market Outlook

🧀 - Hot News: Bitcoin at Crucial Juncture as Analysts Monitor Key Price Metrics

🧀 - Project Review: Smilee Finance

🧀 - Those Sweet, Sweet Memes!

🧀 - Your Favourite Motivation Corner!

Market Outlook

Get ready for a wild ride in the Bitcoin market! The on-chain volume has taken a plunge, indicating less demand and a dominance of small transactions. Let's dive into what this means for investor confidence and the outlook for 2023. (source: glassnode)

Volume Dip: Hold on tight! The overall economical throughput has dropped significantly since early 2021. Exchange deposit volume has also hit a low, suggesting less trading and investor enthusiasm. Holders are playing it safe, as realized profit and loss events are at their lowest levels in three years. They're holding on to their gains (or losses) and not spending much.

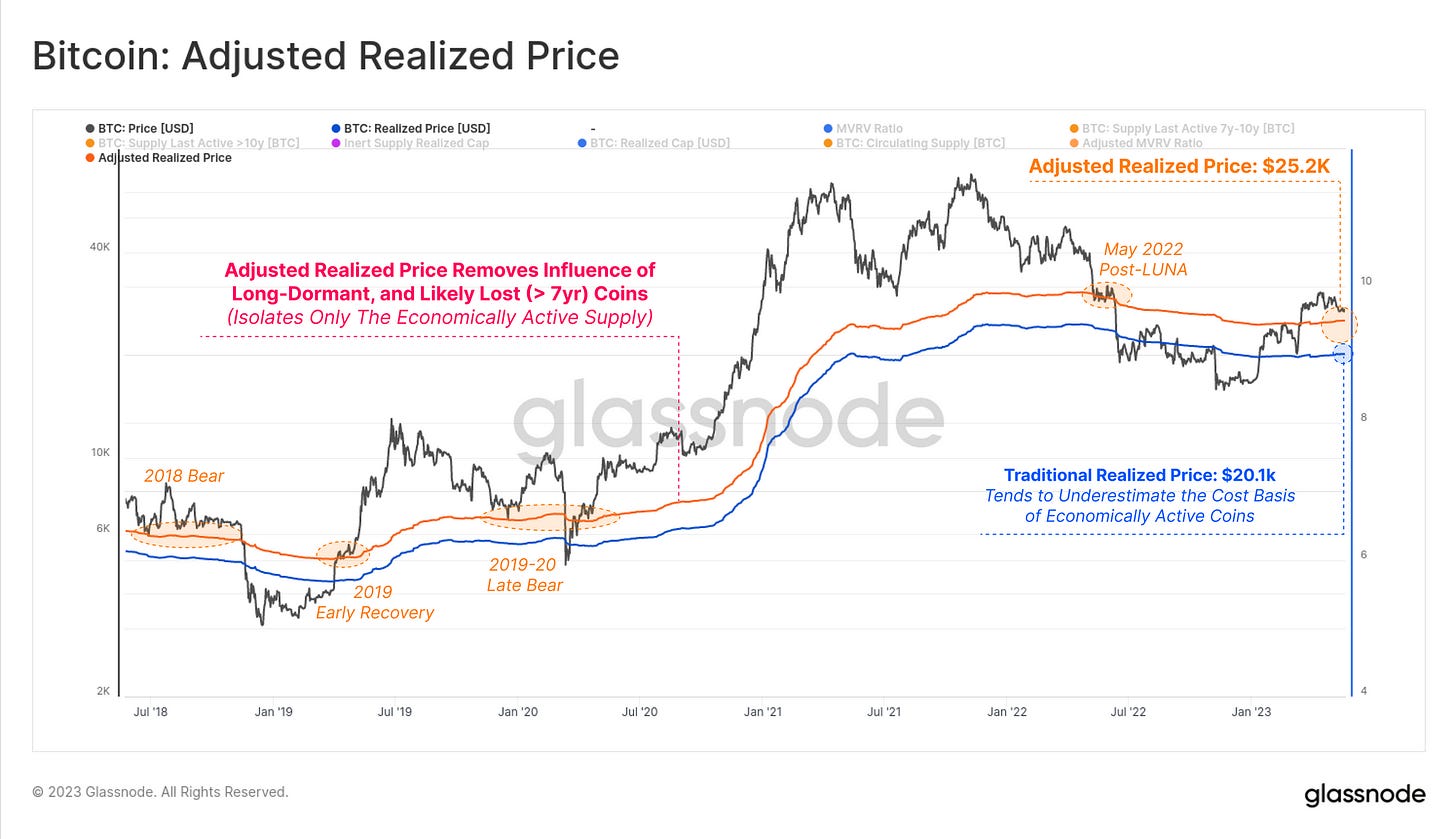

Lack of Spending Thrills: The low volume could be due to holders having a cost basis close to the current price. It means they don't have much incentive to spend their Bitcoin just yet. The Adjusted Realized Price, a fancy term excluding dormant coins, confirms that there's not a lot of profit or loss to be had. We need some excitement in the market to tempt holders to splash their crypto cash.

Holders' Fearless Stance: Brace yourself! Existing Bitcoin holders are a fearless bunch. They remain confident despite the crazy ups and downs of the past. They're like survivors of a wild ride, waiting for higher prices before jumping off. The growing stash of dormant coins shows they're in it for the long haul and not easily shaken.

Dormant Bitcoin Horde: There's a secret hiding place for Bitcoin: the dormant supply. It keeps growing like a hidden treasure. A significant chunk of the circulating supply remains inactive, adding to the low on-chain volume. Holders are hoarding their crypto gems, reluctant to spend them.

Conclusion: Welcome to the Bitcoin rollercoaster! It's a thrilling journey with consolidation, low volume, and reduced trading action. The current holders show unwavering confidence and seem unbothered by price fluctuations. With limited volume and more coins going dormant, there's a lack of new excitement. Survivors of the 2022 market may need higher prices to hop off the ride and consider cashing out their Bitcoin. Hold on tight, as the rollercoaster continues its wild journey!

Disclaimer: The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. The content of this newsletter is solely the opinions of the writers who are not a licensed financial advisors or registered investment advisors. Trading cryptocurrencies poses considerable risk of loss. Authors of this newsletter do not guarantee any particular outcome.

Latest News

Tether’s Diversification Plan Starts with Buying Bitcoin

In a recent interview, Paolo Ardoino, the Chief Technology Officer of Tether and Bitfinex, revealed the company's treasury management strategy and discussed their recent bitcoin acquisitions, as well as their intentions for the remarkable $1.5 billion profit generated in the first quarter of this year.

Ardoino emphasized Tether's commitment to adapt and diversify in response to their recent profitability, stating, "The beauty of our upcoming plans lies in the opportunity to expand beyond our core stablecoin offering and evolve into a comprehensive tech provider.”

The market cap of USDT has defied the bear market, soaring close to its historical peak at $84.1 billion.

Read more at: https://www.theblock.co/post/232194/paolo-tether-diversification

Milady NFTs Price Correction Following Elon Musk's Tweet

The highly sought-after Milady NFT collection has witnessed a retracement in prices after a surge triggered by a tweet from Elon Musk, resulting in top holders of LADYs meme coins enjoying substantial unrealized profits in the millions.

The Milady collection garnered significant attention in May when Elon Musk, the owner of Twitter, posted a tweet featuring a Milady avatar adorned with the words, "There is no meme, I love you." The tweet propelled the NFT collection to new heights, with each NFT being traded for 3.4 ether (ETH) at the time.

The prices of the Milady NFT collection have reverted to levels prior to Musk's tweet, with each NFT plummeting to as low as 3.2 ether per NFT on Thursday, erasing the earlier rise.

Read more at: https://www.coindesk.com/markets/2023/05/26/milady-nfts-get-dogecoin-treatment-as-prices-retrace-days-after-elon-musk-tweet/

Bitcoin at Crucial Juncture as Analysts Monitor Key Price Metrics

Bitcoin has arrived at a pivotal "decision point" for its price trajectory, although current market dynamics are dominated by speculators, according to a recent analysis by Glassnode. The on-chain analyst, known as Checkmate, took to Twitter on May 26 to highlight the brewing showdown in Bitcoin's price.

Glassnode warns that Bitcoin bulls are currently inactive, while the rapid decline in profitability for short-term sellers poses a challenge. Throughout this month, BTC/USD has struggled near significant trend lines, leading to growing concerns among long-time market participants.

As downward price predictions circulate, on-chain analysts are increasingly focusing on short-term holders (STHs) to gain insight into the potential future direction of Bitcoin's price. These STHs, defined as entities holding coins for 155 days or less, are now approaching "reset levels" after a period of heightened optimism, as previously reported by Cointelegraph.

Read more at: https://cointelegraph.com/news/bitcoin-reaches-decision-point-4-btc-price-metrics-to-watch

Binance and Gulf Innova Collaborate to Introduce Crypto Exchange in Thailand by Q4 2023

Binance is joining forces with Gulf Innova, its Thai partner, to establish a new crypto exchange in Thailand. Binance has now obtained regulatory approvals in Thailand to further broaden its presence in the cryptocurrency market.

Under the name Gulf Binance, this joint venture aims to launch the new digital asset exchange in Thailand during the fourth quarter of 2023.

This collaboration will leverage Binance's expertise in digital assets and Gulf's extensive knowledge of the Thai market. The two companies have been working closely for over a year, exploring opportunities to establish a local digital asset exchange that caters to the specific needs and demands of Thai investors.

Read more at: https://cointelegraph.com/news/binance-thailand-crypto-exchange-with-gulf-innova-to-launch

Cathie Wood Warns of U.S. Losing Bitcoin Movement Due to Regulatory System

During Fortune's Most Powerful Next Gen conference, Cathie Wood, the founder of ARK Invest, expressed concerns about the United States falling behind in the Bitcoin movement due to its regulatory system. Wood highlighted the shifting center of gravity in the cryptocurrency industry away from the U.S., citing the example of Coinbase (COIN) obtaining licenses to operate in Bermuda while actively seeking expansion in Singapore.

Wood also referenced significant events that underscore the significance of Bitcoin's concept: "The reason it’s adopted is, first of all, many people like the idea of a decentralized, transparent, auditable monetary system. It was born out of the 2008/2009 crisis when people just lost all trust in financial services," Wood explained. "And, very interestingly, it took another two crises within the last year to prove the concept. FTX failed because it was centralized, opaque, and not auditable."

Read more at: https://www.coindesk.com/policy/2023/05/23/us-is-losing-the-bitcoin-movement-cathie-wood/

Project Review

Smilee Finance

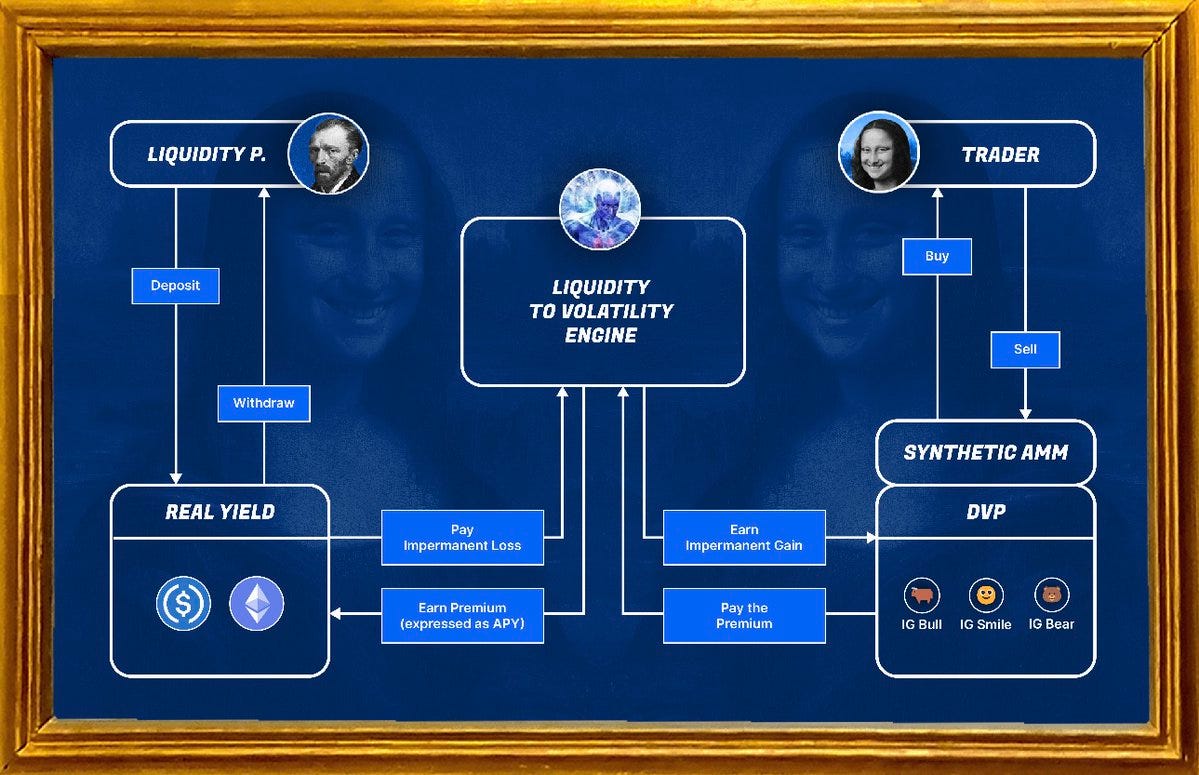

Smilee Finance introduces a groundbreaking concept in the world of decentralized finance (DeFi) by offering the first primitive for Decentralized Volatility Products (DVPs). By redefining Impermanent Loss as a portfolio of options, Smilee transforms a notorious risk into a feature. The protocol enables the creation of volatility-based products and strategies, bringing convexity to DeFi.

What Is Smilee Finance?

Smilee leverages decentralized exchanges (DEXs) to access ample liquidity and a diverse set of assets, overcoming the liquidity challenge faced by options AMMs and other on-chain volatility products. With its innovative approach, Smilee empowers on-chain derivative solutions and paves the way for the products of tomorrow.

First and Foremost: Be Careful

However, it's important to note that, like any DeFi protocol, Smilee carries inherent risks, and users should exercise caution when engaging with the platform. Overall, Smilee Finance presents an intriguing solution that has the potential to revolutionize the DeFi landscape by introducing decentralized volatility products.

want to know more? check out technicalities below:

Disclaimer: The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. The content of this newsletter is solely the opinions of the writers who are not a licensed financial advisors or registered investment advisors. Trading cryptocurrencies poses considerable risk of loss. Authors of this newsletter do not guarantee any particular outcome.

Meme of the Week

Mr Longtail’s Motivation Corner

Quote and Book of the Week

“Your identity emerges out of your habits'“, from Atomic Habits by James Clear

5 Powerful Daily Habits to Improve Your Life

Establish a workout routine. 💪🏼

Eat according to the Intermittent Fasting rules. ⏳

Practice gratitude daily. 🙏🏽

Take care of yourself and dress nicely, even (or especially ;) if you work from home. 👒 🎩

Spend quality time with your loved ones and friends. 🤗

Disclaimer: The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. The content of this newsletter is solely the opinions of the writers who are not a licensed financial advisors or registered investment advisors. Trading cryptocurrencies poses considerable risk of loss. Authors of this newsletter do not guarantee any particular outcome.

Interested in advertising on the Longtail Report?

Contact us at: longtail.report@protonmail.com

We’ll get back to you asap!